Markets to Pay Attention to in the Upcoming Weeks

Author: Charles Ouko

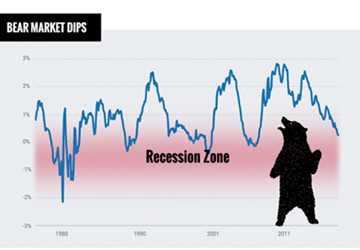

The main U.S. stock indices have all threatened or experienced bear markets since June closes. A bear market is often thought to have started when the price of an asset or index has dropped by over 20% from its most recent high.

It's mostly a question of semantics as to whether the S&P 500 is experiencing a bear market: When prices are considered, the benchmark index fell by roughly 21 percent, despite being down almost 19 percent from its high in January.

Meanwhile, the Dow Jones Industrial Average (DJIA) ended its biggest downturn in over a century by snapping an eight-week losing streak.

It is now unclear if the late-May comeback means that the worst of the downturn is behind us. The market appears to be more concerned about economic growth than inflation, which may be plateauing, given that the Federal Reserve has pledged to keep hiking interest rates.

Because of this, volatility is unlikely to abate anytime soon for investors.

Due to the high level of uncertainty, market volatility is expected to remain for most of this year. The number of variables generating inflation will grow, and we haven't even begun to think about midterm elections.

Rumors of Another Recession

Speaking of speculating, Wall Street institutions have been asserting the potential start date of the upcoming recession. The current opinion is that a recession will likely start in 2023, which explains why traders have recently punished stock prices.

These worries remained unabated despite the stock market's recovery at the end of May. As a result, there are "many bear markets" among the individual S&P 500 members, even though the index didn't formally experience the 20% fall required to be classified as a bear market.

The U.S. economy will likely experience a slowdown next year, but this may not happen, or the slump may be "mild."

It's crucial to keep in mind that every economic cycle ends in a recession. The following one might not be like the previous one. It's just untrue to assert that a recession won't occur at some time.

Concern should be expressed since the slowing of the housing market isn't encouraging for the confidence of either investors or consumers.

Additionally, a growing number of Americans appear to be financially strapped and frequently use credit cards and other forms of debt to make purchases. As a result, the personal savings rate has fallen to its lowest point since the Great Recession, which was 4.4 percent as of April.

July investment strategies

The recent volatility in the stock market is not surprising given the Fed's intention to raise interest rates and indications of the economy's fragility. Therefore, expect additional market volatility as players debate whether the economy can withstand rising interest rates without weakening.

Investors who seek to lower the risk of their entire portfolio are likely to stay away from the bond market. Bonds can also function as a hedge for equities.

Expect increased sector movement on the stock market, notably from producers of products to suppliers of services.

Investors should look more closely at their investment portfolio, emphasizing less on industries that depend heavily on consumer spending, such as communication services and consumer discretionary, and more on sectors that have historically performed well during economic downturns, such as utility consumers staples, and healthcare.